Not too long ago, interest rates were at their lowest, and houses were reasonably priced. However, the landscape dramatically shifted during and after the COVID-19 pandemic, leading to significant increases in housing prices, interest rates, and inflation. But the question is, did they truly reach unprecedented levels? To answer that, let’s take a historical dive into the housing market.

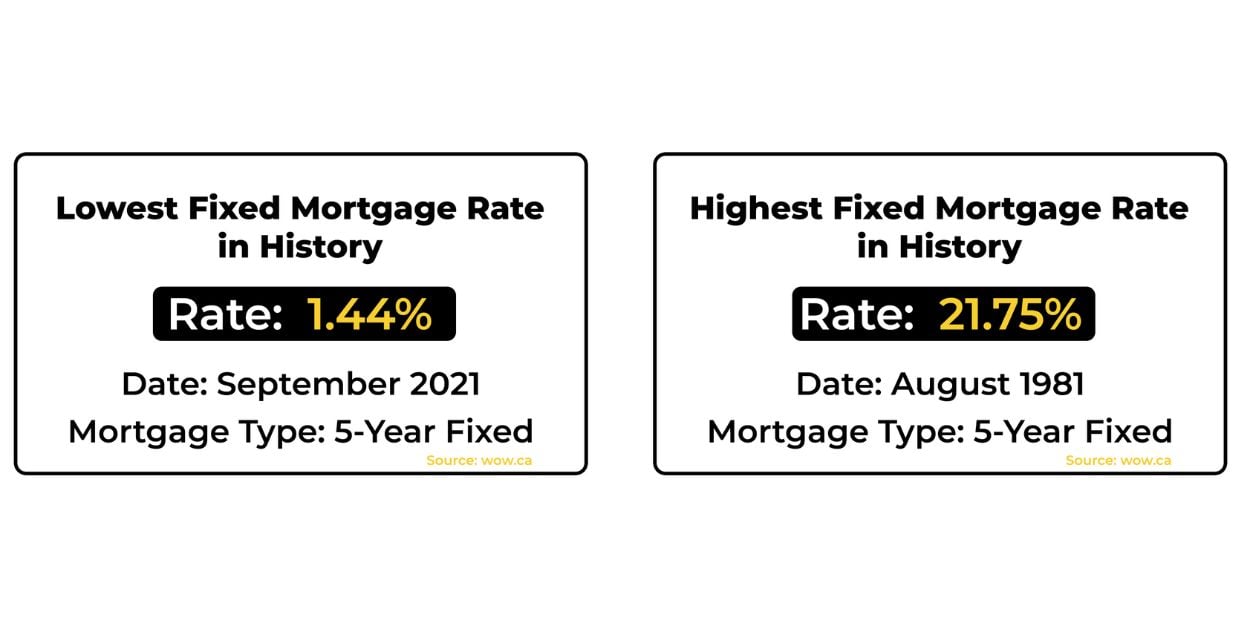

In 1981, Canada experienced its highest fixed-rate mortgage at a staggering 21.75%. Contrastingly, during the COVID-19 pandemic in 2020 and 2021, fixed mortgage rates hit historic lows at just 1.44%. What does all this data really mean? It’s somewhat like the rollercoaster ride we often see in the stock market and other investment portfolios. Market dynamics are a complex interplay of various factors that cause values to rise and fall. Your home, much like stocks, bonds, mutual funds, and even cryptocurrencies, plays a pivotal role in your investment portfolio. In most cases, it stands as the most secure asset you’ll ever own.

The COVID-19 pandemic presented a perceived long-term opportunity. Businesses adopted work-from-home arrangements for their employees, ensuring that commerce continued even in the face of the pandemic.

However, industries that relied heavily on in-person staffing faced significant challenges. Concurrently, there was a shortage of homes available, which, combined with high demand, sent housing prices soaring. As the home-building industry raced to catch up, the demand for homes continued to be strong. However as the Bank of Canada seeks to reach a 2% inflation target, interest rate hikes have become necessary. As businesses realized that employees could return to conventional work settings, the demand for dedicated home offices softened.

All these factors have played their part in shaping the current state of the housing market. As businesses realized that employees could return to conventional work settings, the demand for dedicated home offices softened. All these factors have played their part in shaping the current state of the housing market.

What does all of this mean for you? Whether you’re a first-time homebuyer or a homeowner with a mortgage coming up for renewal, these developments matter. As the Bank of Canada works to control inflation, there’s a possibility of another interest rate increase as soon as October 2023. However, if you’re a first-time homebuyer in a strong position to buy, this shouldn’t worry you too much, as interest rates are anticipated to fall in 2024.

Burlington, Hamilton, Milton, and Oakville. For those who entered the market within the last five years and secured a low mortgage rate, as your 5-year term approaches renewal, you’ll face a much higher rate, which could place stress on your personal finances and lifestyle. However, this situation can also be seen as an opportunity to leverage the equity in your home to reduce debt, move closer to work, secure a better fixed-term rate, or even make your dream home a reality.

Historical rates show a contrast to today’s 5.84%. If you’ve owned a home for more than five years or bought just before the pandemic, you’ve likely seen your home’s value increase in some cases up to 50%, especially in areas like Burlington, Hamilton, Milton, and Oakville. For those who entered the market within the last five years and secured a low mortgage rate, as your 5-year term approaches renewal, you’ll face a much higher rate, which could place stress on your personal finances and lifestyle. However, this situation can also be seen as an opportunity to leverage the equity in your home to reduce debt, move closer to work, secure a better fixed-term rate, or even make your dream home a reality.

Remember, your home is your most significant investment and a resilient asset despite global economic uncertainties. As your trusted realtor, I’m here to provide guidance grounded in facts, helping you make informed decisions. As you contemplate the current state of the real estate market and its impact on your financial decisions, remember that real estate, like any asset class, goes through cycles. It’s a long-term endeavour, and owning a home is a prudent strategy for steady and secure wealth accumulation over many years. Are you ready to make a move in the real estate market? Reach out to me today, and let’s discuss your options and how I can assist you in achieving your real estate goals. In the words of Franklin D. Roosevelt, “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”